Mastering Forex Trading Your Ultimate Course Guide

Mastering Forex Trading: Your Ultimate Course Guide

Forex trading, or foreign exchange trading, has become a popular way for individuals and institutions to make money in the dynamic global economy. If you are considering stepping into the world of forex, you are in the right place. Our comprehensive forex trading course covers everything you need to know to get started. We will explore the fundamentals, technical analysis, trading strategies, and more, to equip you with the knowledge necessary to navigate the forex market successfully. For a reliable start, check out one of the best resources at forex trading course Online Trading Brokers as you begin your journey.

Understanding Forex: The Basics

Before diving into trading strategies, it is important to grasp the basic concepts of forex trading. Forex refers to the global marketplace where currencies are exchanged. Unlike a stock exchange, the forex market operates as a decentralized market, meaning trades occur over-the-counter and are not conducted through a centralized exchange.

The forex market is the largest in the world, with a daily trading volume exceeding $6 trillion. Currencies are traded in pairs, for example, EUR/USD (Euro/US Dollar). The first currency in the pair is called the base currency, while the second is the quote currency. A currency pair’s exchange rate is determined by the relative value of the two currencies, which can be influenced by several factors, including economic indicators, geopolitical events, and market sentiment.

The Importance of Education in Forex Trading

Education is key to success in forex trading. Many novice traders jump into the market without adequate knowledge and end up facing substantial losses. A well-structured forex trading course will educate you on market dynamics, trading platforms, and risk management practices.

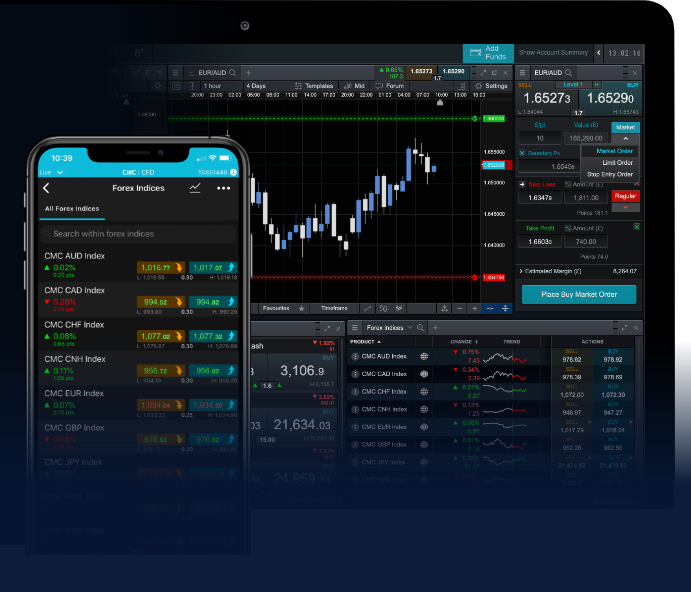

In addition to providing theoretical knowledge, a good course will also offer practical exercises. Learning how to operate trading software, analyzing charts, and conducting trades in a demo environment will build your confidence before entering the live market.

Technical Analysis: The Art of Predicting Market Moves

Technical analysis involves using historical price data and chart patterns to identify potential future market movements. In forex trading, traders rely heavily on technical analysis because currency prices often move in trends. An effective forex trading course will teach you how to read charts, recognize patterns, and utilize indicators such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence).

The ability to analyze price action and make informed decisions based on market trends is essential. With time and practice, you will be able to spot opportunities and make calculated trades based on technical indicators.

Fundamental Analysis: Understanding Market Influences

While technical analysis focuses on price action, fundamental analysis examines the underlying factors that influence currency value. Economic indicators, such as GDP growth, unemployment rates, inflation, and interest rates, play a critical role in shaping market expectations and currency valuations.

A comprehensive forex trading course will help you understand how to interpret economic data releases and news events. Staying informed about global economic conditions and their potential impact on currency pairs is crucial for making knowledgeable trading decisions.

Developing a Trading Strategy

The cornerstone of successful trading is a well-thought-out trading strategy. A trading strategy outlines your approach to the market, including entry and exit points, risk management, and trade size. A successful forex trading course will guide you in developing a personalized trading strategy that aligns with your goals, risk tolerance, and trading style.

One popular approach is the “trend-following” strategy, where traders seek to identify and follow existing market trends. Alternatively, “range trading” involves taking advantage of price fluctuations within defined support and resistance levels. Discussing these strategies in a course will provide you with a solid foundation and the tools needed to create your own unique approach.

Risk Management: Protecting Your Capital

In forex trading, risk management is paramount. Understanding how to protect your trading capital is essential for long-term success. Key components of risk management include setting stop-loss orders, determining position size, and ensuring proper leverage usage. A good forex trading course will emphasize the importance of risk management and provide you with strategies to manage your risk effectively.

One common rule is to never risk more than 1-2% of your trading capital on a single trade. By implementing risk management techniques, you can protect yourself from significant losses and ensure the sustainability of your trading activities.

Choosing the Right Trading Platform and Broker

The trading platform and broker you select can have a significant impact on your trading experience. A quality forex broker will offer a user-friendly platform, competitive spreads, reliable execution, and excellent customer support. Many forex trading courses provide insights into selecting a broker that fits your needs, ensuring you have access to the resources necessary for success.

Moreover, consider factors such as regulatory compliance, deposit and withdrawal options, and available trading tools when making your selection. Using reputable online trading brokers will help you avoid pitfalls and foster a secure trading environment.

Putting Everything Together: Simulation and Practice

Before risking real money, practicing your skills through simulated trading is highly recommended. Many forex trading courses include access to demo accounts where you can apply what you’ve learned in a risk-free environment. Use this opportunity to refine your trading strategy, practice your analysis techniques, and gain confidence in your abilities.

Once you’ve developed your skills and created a trading plan, consider switching to a live account with a reasonable amount of capital to start. Always remember that trading involves risks, and maintaining discipline is key to becoming a successful trader.

Conclusion

Forex trading can be a lucrative venture, but it also carries risks. By investing time in a structured forex trading course, you can gain the knowledge and skills necessary to navigate the complexities of the forex market effectively. From learning fundamental and technical analysis to developing a robust trading strategy and managing risk, education is your greatest asset. With the right resources, including access to trustworthy Online Trading Brokers, you can set yourself on the path to success in forex trading. Start your journey today and unlock the potential of this vibrant and exciting marketplace!